BMI Federal Credit Union

Financial Education: Savings

Learning Modules

Learn how to save money and the options available to help you meet your savings goals.

Learn about how to set aside money for emergency expenses so that you are prepared for the unexpected.

|

Calculators

With this savings calculator, you can see how your money will grow with compound interest.

Creating a robust emergency fund is the best way to prepare financially for the unexpected. This emergency fund calculator show you how much you need to save each month to reach your emergency fund savings goal.

Resource Articles

Frugal living not only saves you money, it pays huge dividends. Is a penny saved really a penny earned?

Learn how interest can make a big difference in the money you earn and the money you owe.

|

Financial Education Videos

Pay Yourself First

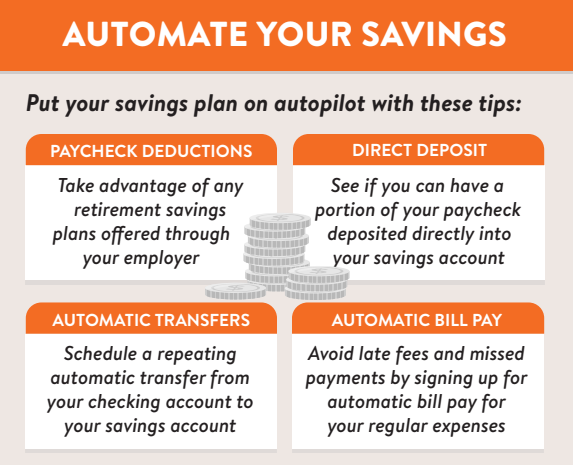

Watch this video to learn how "Pay Yourself First" is an effective strategy that can help you prioritize your savings goals.

See how the strategy "Pay Yourself First" can help you towards your savings goals.

|

Emergency Fund Boot Camp

Learn what an emergency fund is and is not, why you need an emergency fund, how much money should be in it and tips on putting that money aside.

Avoiding Lifestyle Creep

Lifestyle creep can sabotage your long-term savings goals. Learn how to recognize and counter lifestyle inflation.

|